“Don’t work for money. Make money work for you.”

– Robert Kiyosaki

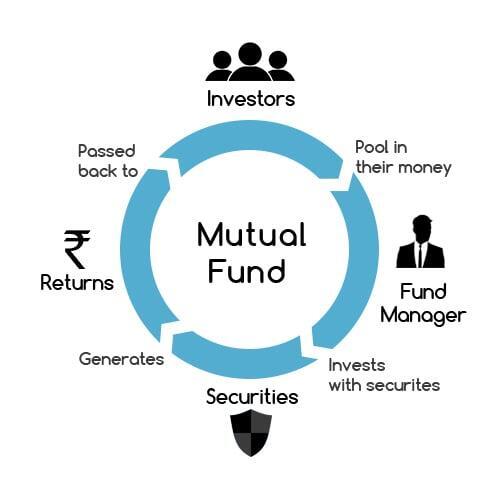

Investing in mutual funds means pooling your money with other investors and letting a professional fund manager grow it for you.

Whether your goal is short-term stability or long-term wealth creation, mutual funds offer the right balance of growth and safety.

Why Choose Mutual Funds?

Diversification: Reduce risk by investing in multiple securities.

Liquidity: Redeem anytime when you need money.

Professional Management: Experts handle your investments.

Affordability: Start small, even ₹500 per month.

Flexibility: Funds for every goal & risk appetite.

SIP vs. Lumpsum Investment: Understanding the Difference

When investing in mutual funds, you can choose between two main methods: Systematic Investment Plan (SIP) and Lumpsum Investment. Here's how they work and how they compare to traditional savings instruments:

Systematic Investment Plan (SIP)

What It Is: A SIP allows you to invest a fixed amount at regular intervals (monthly or quarterly) in a mutual fund.

Comparison to Recurring Deposit (RD): Similar to an RD, a SIP promotes disciplined saving by enabling you to invest regularly. However, unlike an RD, SIP investments grow with market-linked returns and offer higher potential over time.

Key Benefits:- Rupee cost averaging minimizes the impact of market volatility.

- Affordable starting points with investments as low as ₹500.

- Ideal for long-term wealth creation.

Lumpsum Investment